- The real estate industry and the housing market were dramatically impacted by the COVID-19 shutdown.

- In March and April, transaction volume dropped by nearly 40% in only 3 weeks.

- Transaction volume bottomed out in late March and early April then rebounded, slowly trending up since mid-April.

- After nearly 2 more months, volume has reached the previous peak level last seen in early March.

- June had the highest transaction volume of the year so far.

- A lot of uncertainty remains, with agents still hurting from lost business this spring and states/counties pausing or reversing their opening plans.

This continues to be an unprecedented situation. Since our last look at Amitree’s proprietary data on real estate transaction volume amid COVID-19, things have improved — transaction volume bottomed out and then rebounded. And while it feels like the real estate industry has turned the corner, it may be too soon to say we’re out of the woods.

At Amitree, we’re continuing to analyze large volumes of our proprietary data to get quantifiable answers about the impact of the pandemic. Folio, our email organization tool for real estate, is used by 100,000 real estate agents, mortgage brokers and transaction coordinators, offering a window into the health of the industry.

As a heavily data-driven company, we think it’s important to look at and extrapolate from our data on transaction volume to help understand the impact of the pandemic.

What New Data Tells Us

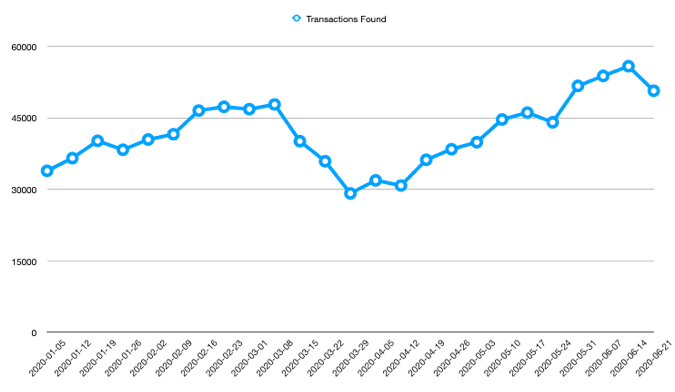

Folio automatically identifies new real estate transactions, helping our users stay organized, as they manage tens of thousands of transactions each week. March is typically a strong month for transaction volume, with a weekly average volume of almost 48,000 new transactions managed in Folio. See Figure 1.

Figure 1

| Week | Transactions Found |

| 2019-02-24 | 45,319 |

| 2019-03-03 | 46,627 |

| 2019-03-10 | 49,063 |

| 2019-03-17 | 51,149 |

| 2019-03-24 | 45,661 |

This year was a very different story. Transaction volume started the month in similar territory, with a peak of 47,819 transactions the week of March 8. But the pandemic and shutdown led to a steep decline for transaction volume, which fell more than 39% later in the month at a time that should have been the peak buying season. See Figure 2.

The week of March 29 was the trough, with volume down to only 29,160 transactions. The average weekly transaction volume for March 2020 was only 39,968. Compared to the same month last year, this is about 16% lower volume.

Figure 2

| Week | Transactions Found |

| 2020-03-01 | 46,830 |

| 2020-03-08 | 47,819 |

| 2020-03-15 | 40,118 |

| 2020-03-22 | 35,911 |

| 2020-03-29 | 29,160 |

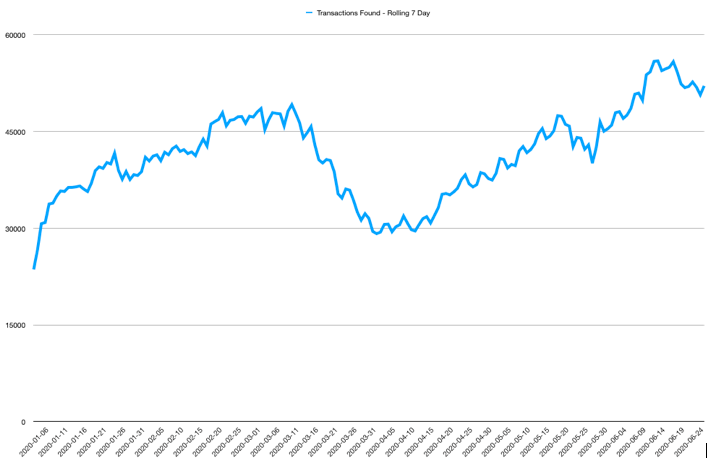

While the week of March 29 was the low point of the drop, volume remained low for the next several weeks of April before trending back up. It really wasn’t until the week of May 17 — more than 2 months after a U.S. national emergency was declared — that we began to see real estate transaction volume return to the pre-pandemic highs of March. It took another two weeks until transaction volume returned to levels equivalent with the 2019 Spring season (week of May 31) See Figure 3.

Figure 3

| Week | Transactions Found |

| 2020-04-05 | 31,895 |

| 2020-04-12 | 30,812 |

| 2020-04-19 | 36,208 |

| 2020-04-26 | 38,432 |

| 2020-05-03 | 39,901 |

| 2020-05-10 | 44,665 |

| 2020-05-17 | 46,108 |

| 2020-05-24 | 44,073 |

| 2020-05-31 | 51,706 |

| 2020-06-07 | 53,801 |

| 2020-06-14 | 55,834 |

| 2020-06-21 | 50,691 |

The chart below shows weekly real estate transaction volume since the beginning of this year. It’s apparent how the spring home buying and selling season’s typical growth in transaction volume was impacted by COVID-19 beginning around March 8. Here, a sharp 3-week decline was followed by a more gradual recovery stretching out for several months.

Looking at data on a rolling 7-day basis, the trend of a V-shaped fall and recovery is even more pronounced.

It’s early, but we may well be witnessing the spring buying season simply pushed out by 2-3 months into the summer. Or we may be seeing all the spring’s activity condensed into a shorter timeframe.

What the Data Doesn’t Say

It is also important to caution what our data does not show. The impact of COVID-19 on other key economic indicators, such as home price, interest rates, days to close, etc. is not reflected in Amitree’s transaction volume data.

We also haven’t broken down our transaction volume by region, which might mean agents in some regions of the country are still struggling while others are adjusting to a new normal.

It is also unclear from the data if or how the pandemic has impacted sales motivations, and whether COVID-19 economic repercussions or other financial pressures are motivating rebounding transaction volume.

A recent poll conducted by the National Association of Realtors reports that nearly half (47%) of homeowners have considered selling during the pandemic. Meanwhile, signed contracts for new home sales are up according to the latest figures. How these trends will impact the industry remains unclear.

Lastly, the data doesn’t tell us what will happen from here and whether we’re back in “normal” territory or we’re seeing a pent-up demand playing out in a condensed timeframe. Only time will tell.

Conclusion

One bright spot that stands out is the tenacity and adaptability of the real estate industry.

In the midst of lockdowns, stay-at-home orders and social distancing, the industry continued to work hard to serve the needs of home buyers and sellers, often with the help of technology. This is borne out by the data, which shows that transaction volume begins to recover in April, long before mid-May when many restrictions were eased. Furthermore, even with almost the entire country under some form of stay-at-home order, real estate agents still found ways to transact, helping buyers and sellers who had no choice but to move during such a complex time.

However, more challenges lie ahead. Recent volume has not yet made up for the lost business that so many in the industry experienced in what we all expected would be a busy spring home buying and selling season. When or if the industry will recover from these losses remains unknown. Meanwhile, economic pain continues and there is still uncertainty about the future.

At Amitree, we will continue to track data on real estate transaction volume over the coming months in an effort to provide valuable insights to the real estate industry.

*All data in this report is based on new transactions identified by Folio. Amitree considers this data to be representative of — but not actual — number of new real estate transactions commenced in the United States over the specified time period.

Who we are

We've built Folio: the first AI email assistant for professionals.

Folio plugs directly into your work email inbox and automatically organizes your email, giving you contextual access to all the information you need to increase your productivity in minutes.

We are a team of passionate product people and engineers that gets excited about solving complex processes and creating value for people.

We're a venture funded company backed by Accel Partners, Vertical Venture Partners, and other leading venture capital firms and angel investors such as Ash Patel and Jerry Yang.