Closing a real estate transaction on time can be tough under ordinary circumstances, but this year is far from ordinary. The pandemic, lockdowns, and uncertainty have added more complexity to an already complex process.

Knowing how to close on time under these circumstances requires knowledge of the process, the right tools, and special attention to get through common hold-up points.

In this three-part series, we’ll look at each of these key areas, starting with the residential real estate transaction closing process itself.

How Closing Timelines Vary During COVID

Knowing what you need to do, and by when, is especially important for agents helping clients through the home sale or purchase process during the coronavirus pandemic.

Even with COVID-19, the real estate market has been very active in some parts of the country. We have all heard stories of multiple offers and homes bought sight-unseen, due to the circumstances of the current moment.

However, Ellie Mae reports that the average time to close a residential property transaction is still hovering around 46 days. Financed sales closing in 45 to 60 days is still the norm.

The first steps to closing a real estate transaction on time

Closing your real estate transactions on time during a pandemic requires agents to facilitate a process with a lot of moving parts. Here are 4 items to address right away:

1. Consider adding a Coronavirus Addendum to your purchase offer terms

Technically, the clock starts ticking once the offer contract is signed. But as a real estate agent, you can help set your clients up for success by ensuring the timeline is reasonable.

Inexperienced buyers are often overly optimistic when it comes to picking a settlement date — they just don’t know everything that goes into the sale of a home — so be sure to guide them.

A timeline of 45 to 60 days can offer a buffer in these times of uncertainty, while a coronavirus addendum can help ensure a good sale doesn’t fall through due to circumstances beyond anyone’s control.

2. Escrow and Earnest Money

With so much uncertainty in many local markets due to the pandemic, earnest money is really a must as a good-faith deposit to ensure sellers that the buyer is serious.

A buyer may be ready to hand over a check with their purchase offer, but it can take as much as 5 to 10 days to make the arrangements for a title company, escrow service or attorney acting as an escrow agent to receive the buyer’s earnest money and properly deposit it.

Earnest money is credited towards the down payment. Real estate agents should check that it’s handled properly at the outset to avoid a delay at closing.

3. Loan Financing and Approval

Note the mortgage commitment due date specified in the contract. Sellers will be looking to make sure the buyer is sticking to the timeline and that financing is being secured.

For the buyer’s agent, loan financing is the top priority. This is where underwriters really scrutinize the buyer’s numbers. Agents can help by making sure their buyer understands what loan documentation is needed and that it is gathered and submitted.

Even with a pre-approval, you can expect it to take anywhere from 2 to 4 weeks for the buyer to receive their conditional loan approval.

4. Title and Insurance

As real estate buyers are securing financing, sellers should be focused on resolving any issues with the title company.

Order a title search to verify ownership and ensure that the home is saleable. Title insurance is also needed to protect the buyer and their lender from past liens, encumbrances and defects in the title.

About one-third of titles have defects that need to be cleared before a mortgage or transfer of ownership can move forward. Some titles clear quickly, others may take so long to fix that they can kill a sale.

You may need to do some legwork to ensure a title commitment and stay on schedule. Make sure to start early and plan for the title process to take 2 to 3 weeks.

What to Do Next

As soon as the initial parts of the process are under way, it’s time to turn your attention to the next items of importance. While crucial, these are not usually as time consuming:

5. Inspections and Repairs

Most lenders require one or more types of home inspections to make sure hidden problems aren’t waiting for the new owners. Home inspections don’t take long to book or to complete, but a few points deserve an agent’s attention.

Scheduling an inspection usually requires coordination of the inspector, the seller and often the buyer, who also may want to attend..

Inspections should also be completed early enough in the timeline to allow the buyer and seller to come to an agreement on any repair requests and for the fixes to be completed.

You may need to help with scheduling the inspection, communicating repair requests and verifying repairs, a process which could span 1 to 2 weeks.

6. Appraisal and Price Adjustment

The appraisal is another lender-required item needed to verify the fair market value of the home. The appraisal also determines the loan-to-value ratio and satisfies other underwriting requirements.

Hopefully, the seller and their agent have priced the home correctly according to the market and the buyer and their agent have responded with a suitable offer. If not, you all could find yourselves back at the negotiating table.

In most markets, ordering an appraisal takes between 5 to 10 days. Any renegotiations after the appraisal report comes back need to be resolved before the final loan can be approved.

What to Follow up on

As closing day approaches, your main task will be to follow up on all the details. Agents will need to ensure that financing, title commitment, and insurance have been secured and finalized. Further, it is important to ensure agreed-upon repairs have been completed. Beyond this, you’ll need to focus on these items as you near the finish line:

7. Contractual Agreements

Any other terms and conditions described in the offer contract need to be met before closing and settlement. This includes funding requirements and constructive approval or removal of any remaining contingencies.

8. Final Walk-Through

The final walk-through is one last chance for the buyer and their agent to confirm the condition of the property prior to closing. The buyer can check completed repairs and the presence of any items to be conveyed in the sale.

9. Closing Disclosure

At least 3 days before the settlement date, the buyer should receive their closing disclosure. The buyer’s agent should ensure there are no mistakes and that the buyer understands the closing cost, tax, insurance obligations and anything else they’ll be responsible for at the closing.

10. Closing Day

On closing day, you should be able to relax a bit. With the settlement agent in charge, you’ll be there to answer any last-minute questions or concerns your client has.

With everything going on, clients will be looking for more reassurance and guidance than ever. Getting to closing is a lot of work. Folio can help you save time and stay on top of your transaction communications. It’s our trick for how to close on time every time, even under these stressful circumstances.

Who we are

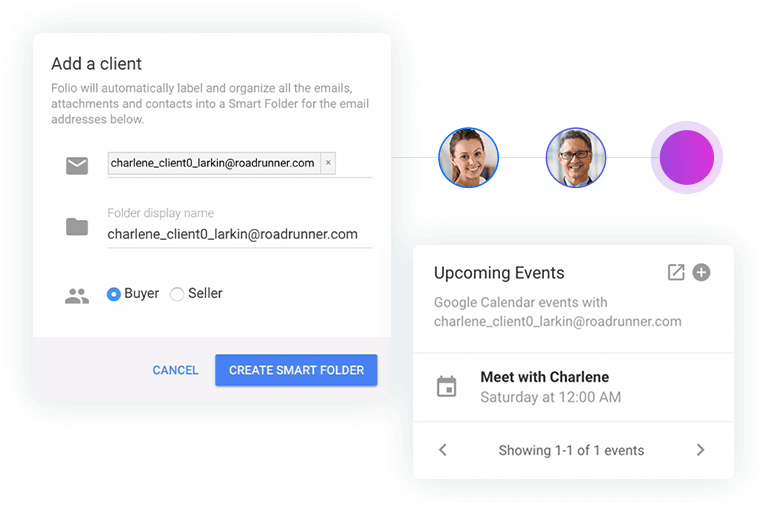

We've built Folio: the first AI email assistant for professionals.

Folio plugs directly into your work email inbox and automatically organizes your email, giving you contextual access to all the information you need to increase your productivity in minutes.

We are a team of passionate product people and engineers that gets excited about solving complex processes and creating value for people.

We're a venture funded company backed by Accel Partners, Vertical Venture Partners, and other leading venture capital firms and angel investors such as Ash Patel and Jerry Yang.