Just what exactly is going on with the housing market in 2022? It turns out — quite a lot!

If you are looking to get your year off to a good start with the info you need to know, this deep dive into housing market 2022 trends, market predictions and tips for real estate agents is a must-read.

Here’s our agent’s guide to the housing marketing in the US in 2022.

Part 1: 2022 Real Estate Trends and Forecasts

With the 2021 housing market being one for the record books, everyone is wondering what will happen in 2022.

To figure this out, let’s first try to get a sense of where we are.

Where Do Things Stand Now?

On average, home prices have gained 4.6% every year since 1980. However, home price appreciation in 2021 blew this trend out of the water. Overall price growth in 2021 stood at 19.9% — with a 12-month record set between August 2020 and August 2021.

According to Realtor, the median listing price in January 2022 has climbed to $375,000, up 10% from last year and 25% from January 2020, while the median existing-home sales price clocked in at $358,000.

The 2022 housing market is currently said to be 3.8 million single-family homes short of what is needed to meet demand, with only 1.8 months’ supply.

Numerous other factors are also in play as we try to predict what’s going to happen with this year’s housing market — from the pandemic, to inflation, the economy and more.

Here are a few of the questions we’ve been asking ourselves along with some answers from the experts.

Will Prices Increase? And by How Much?

In terms of 2022 home prices, we may be in for another wild year. Every agent seems to have a story about doing gangbusters business in 2021, and at the beginning of the year, most experts didn’t think such things could continue at the same frenzied pace.

Lawrence Yun, chief economist for the National Association of Realtors, told MarketWatch he expected home price growth to return to normalcy, with an overall price appreciation of only 5% for the whole year.

The Mortgage Bankers Association actually predicted a 2.5% dip in prices by the fourth quarter due to higher borrowing costs and other economic factors.

In a survey of 2022 home price predictions, CoreLogic and Redfin predicted very modest growth of 1.9% and 3.1%, respectively, while Fannie Mae and Freddie Mac predicted more robust 7.9% and 7.0% growth, respectively.

Last fall, Goldman Sachs and ZIllow had predicted 13.5% and 13.6% increases, respectively, between October 2021 and October 2022. However, Zillow has since decided to revise their prediction, foreseeing a 16.4% spike by December 2022, primarily due to a continuing inventory shortage.

It turns out that knowing what home prices are going to do this year is one of the more difficult 2022 housing market predictions to make.

Most experts think prices will continue to rise, but by how much is yet to be determined.

What About Inventory and Supply?

Housing inventory in 2022 may be a little easier to predict than home prices, but the forecast may not be what homebuyers want to hear.

Buyers really got walloped in 2021, with what was said to be the lowest supply of housing in more than 40 years. An amazing 72% of homes received multiple offers in April 2021 bidding wars, up from 45% back in 2020.

Unfortunately, these supply woes haven’t been fixed since then. Inventory in December 2021 stood at just under 1 million homes. That’s down 17.5% from December 2020 and 37.8% from December 2019, when there were nearly 1.7 million homes on the market.

Fortune has found that out of 327 real estate markets tracked by Zillow, 254 have inventory down 30% or more compared to December 2019. In 54 of these markets, inventory is down by more than 50%.

New construction is also likely to remain low in 2022, inching up only about 0.3% for the year.

A seasonally-adjusted estimate of new construction houses for sale at the end of December was 403,000, a modest 6.0 month supply at the current rate of sales.

Meanwhile, the inventory of active listings is said to be down 57.1%, compared to 2019.

What’s Going On With Demand?

A discussion of housing supply wouldn’t be complete without a look at demand.

A key real estate trend over the last 40 years has been the age at which first-time buyers get their first home. That age is typically around 33 years old, and, as NAR researcher Jessica Lautz points out, a wave of 23.4 million Millennial adults are now aging into this specific demographic.

While some first-time buyers are facing setbacks, like pricey homes, stagnant wages and a lingering pandemic, others are in a better position.

A huge number of Millennials moved home during the pandemic, saving on rent and paying down student debt, which may position them to place an offer and close on a home in 2022.

Are Interest Rates Going Up and By How Much?

Almost everyone expects mortgage rates to rise in 2022. It’s probably one of the easiest real estate predictions to get right in 2022. In January, Fed Chair Jerome Powell made it clear that federal funds rate hikes were coming to try to tame too-high inflation.

Just how many rate hikes real estate professionals should expect in the 2022 housing market is still up for debate, but the spread ranges from two to seven or more, plus additional increases in 2023.

If and when they happen, those 25 basis-point hikes from the Fed will eventually result in everyone’s rates to inching up, including mortgage lenders. But just the news that rates were likely to rise has already led to a surge in the cost to borrow for a home.

In January, mortgage rates experienced their biggest one-month jump since 2013, from an average of 3.11% to 3.64% for 30-year fixed mortgages.

That’s still a great rate for a mortgage, but it is likely to cause a few things to happen in homebuying and selling.

First, buyers on the fence may jump into the market early this year to try to lock down the best rates before they’re gone.

But next, as rates continue to rise, some buyers and sellers may decide to sit things out. That’s because buyers could be priced out and sellers could find it harder to get the price they want for their home as they face these market headwinds.

As for how high mortgage rates are going to go, we’re not talking stratospheric, at least this year. HousingWire’s lead analyst Logan Mohtashami predicts an upper end range in mortgage rates of 3.375%–3.625%. Bankrate’s chief financial analyst Greg McBride predicts a 2022 high of 3.75%. And CoreLogic’s Frank Nothaft predicts an overall average for the year of 3.5%.

In a wider context, these are still great mortgage rates — as Nothaft points out, rates averaged 4.1% for the decade of 2010 through 2019 — they’re just not quite as great as the 2.96% average of 2021.

What Else Is Impacting the Housing Market?

A lot of other things are impacting the housing market in 2022. Some parts of the country are still dealing with the pandemic and its fallout.

A Census survey last year showed that 23.5% of households had at least one family member working from home and that fact may end up influencing homebuying and selling decisions this year.

NAR’s Jessica Lautz points out that a Realtors Confidence Survey showed 88% of buyers last year chose a suburban, small town or rural area. Buyers are finding that space, affordability and inventory is often better in these locales.

Convenience to family and friends has also become the second-most important factor for homebuyers according to NAR, showing buyers are thinking more about quality of life issues in their decisions.

Homebuyers are also thinking about the runaway prices of more than their homes.

The most recent Consumer Price Index, a key inflation measure, shows prices are rising at the fastest pace in 40 years, up 7.5% since last year. HousingWire notes that hourly wages are also up, but only by about 5% over the last year.

These issues, while not directly related to the housing market, are likely to have an impact this year, too, as buyers try to save for a down payment, pay down debt and afford their new mortgage.

Part 2: Buyer and Seller Analyses for Agents

As you may have gathered, there’s a lot going on with the 2022 housing market, and we’re only just getting started with homebuying season.

But it is possible to draw some conclusions that may be useful for real estate agents getting ready for another year for the record books.

When It Comes to Buyers…

Real estate agents working with buyers in 2022 have their work cut out for them. But the right approach could help them end the year on a high note.

- Who: Expect an influx of Millennial homebuyers. Not everyone experienced the pandemic the same. First-time buyers are still out there and many will be looking for an agent to guide them.

- What: Plan on meeting buyers who are looking for more than the right price. This year’s buyers may prioritize considerations such as location, convenience, family life and more.

- When: Buyers could be knocking on your door before you know it. With rates predictably set to rise over the course of 2022, many buyers could be looking to lock in a favorable rate early in the season.

- Where: Opportunities will still exist for urban locales, but agents in suburbs and small towns may see more than the usual traffic as buyers look for work/life balance.

- Why: Homeownership remains a dream of many across the country, and 2022 will find millions of buyers making that dream a reality. As an agent, you’ll play a central role in their journey.

- How: Buyer education remains an important part of a real estate agent’s job. It will be important to help put prices, interest rates and other local market factors in context for your clients.

When It Comes to Sellers…

For agents working with sellers in 2022, there are also many ways to come out ahead when you take the right approach.

- Who: Agents should expect sellers in 2022 to be looking for a mix of things. Some will be thinking about getting the best price possible, while others will be focused on finding a new home that better suits them.

- What: Most home sellers are going to be focused on the increasing value of their home over the last few years, but there are other factors to consider, such as the price of their next home and the rate of their next mortgage.

- When: Sellers who sell now are already likely to realize great gains in the value of their home, but sellers who delay for later in the year may see slower appreciation as headwinds blow.

- Where: Opportunities abound everywhere, but agents in urban areas may find more sellers seeking advice on selling and moving to the country, or at least to the suburbs.

- Why: Sellers in 2022 won’t be driven solely by profit. They’ll also need to find a new home that will meet their needs, whether it’s more house or a slower pace of life.

- How: Sellers need an agent who can be a great guide to help them during a time like this. Your job will be to set realistic expectations and make sure transactions proceed as smoothly as possible.

Part 3: 10 Tips for Real Estate Agents for 2022

For real estate agents looking for how to make the most of the 2022 housing market, try these 10 tips.

1. Prepare for Another Crazy Year

We have a few ideas about what might happen in 2022, but a lot is still unknown.

Prices and interest rates are going up, supply is staying low, and demand is staying high.

A bidding war could be on the horizon. Or, buyers could have difficulty finding affordable homes. Or, sellers could want to hold out for even bigger sales prices.

It’s too early to say for sure, but 2022 won’t be boring.

2. Stay Tuned Into the Data

Real estate data and expert analyses can help you make better decisions as a real estate agent.

As Zillow found out, you’re first prediction isn’t always correct. New information may come along that changes your perspective and guides you to offer more nuanced advice to your clients.

Stay tuned into updates throughout the year for the best results.

3. Know How the Local Market Compares

Clients are likely to see some big headlines this year about national real estate trends, but those data points may not always lead them to the right conclusions.

“Location, location, location” is the real estate mantra for a reason. All real estate is local, even with the crazy things happening in this year’s housing market.

Continue to monitor the local market and realize what you see on the ground might differ from the national data.

Clients will appreciate agents that can contrast that local intel with the big headlines, helping them make better buying and selling decisions.

4. Brush up on Historical Knowledge

History buffs and trivia fans may do well as real estate agents in a year like 2022.

As interest rates climb, some buyers may be dismayed they won’t enjoy the same low rates as buyers did last year. But you can always remind them of past eras like the 1980s, when mortgage interest rates climbed to double-digits.

A well-rounded perspective on all things homebuying and homeselling is always helpful when dealing with clients.

5. Help Buyers Look for Deals

With so much competition for properties and the likelihood of ever-increasing prices, some buyers may be frustrated with their options.

Often, the perspective and advice of a Realtor can help.

Help cash-strapped buyers look for deals where they otherwise wouldn’t. Instead of turnkey properties in the best neighborhoods, explain the benefits of fixer-uppers in up-and-coming locales.

6. Help Sellers Get the Best Price

A great Realtor can be key for sellers in the 2022 housing market as well.

Use your expertise to help with prepping properties and buyers for a sale, staging, timing listings, reviewing comps, negotiating offers and more.

While the market may do a lot of the work for you this year, there’s still plenty to keep a listing agent busy.

7. Circle Back with Cold Leads

As 2022 gets underway, it might be a good time to circle back with cold leads, as well.

A lot has changed over the last few years and many of your past prospective leads who weren’t ready to jump into the housing market in 2019 or 2020 may be in a different place today.

There are those buyers and sellers who were beginning to think about it, but just weren’t ready pre-Covid, then there are those who took a “pandemic pause” on their house search or home sale.

Find out what these leads are up to today and whether you can help them reach their goals.

8. Market Toward New Lifestyle Trends

Many coming out of the other side of the pandemic are looking for a change of pace, and a real estate agent may be just the person to help.

Consider tailoring your marketing messages to new market segments — remote and hybrid workers looking to move, those wanting to be closer to family and friends, and others looking to make a change.

With the arrival of 2022, now’s a great opportunity to explore a new niche.

9. Tout Your New-Found Convenience

Real estate leads who are first-timers or have been out of the game for a while are going to be surprised about how much more client-centric the process has become since 2019.

Though things were moving in a more technology-focused direction, the pandemic accelerated the trend.

Recognize that touting your new-found convenience with options like remote client meetings, touchless showings and digital closings could be a real advantage with some prospects.

10. Get Organized with Folio

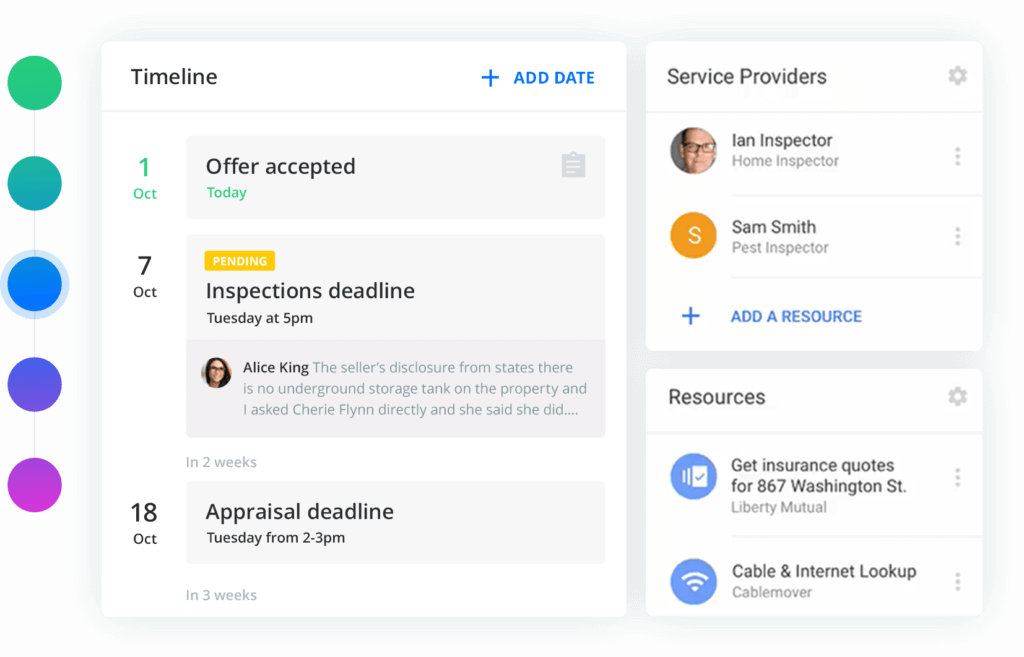

It’s always a great time to get more organized in your client communications and transaction process, and 2022 is no exception. Real estate professionals can benefit from saving time and looking like a pro by using Folio.

Folio is an email add-on that works with your existing Gmail or Outlook email to streamline your agent workflow. Our AI-powered algorithms save you time and hassle organizing your transactions, staying on top of deadlines and providing automatic progress updates to your clients.

Try Folio today for free and save up to 5–10 hours on your next transaction.

Who we are

We've built Folio: the first AI email assistant for professionals.

Folio plugs directly into your work email inbox and automatically organizes your email, giving you contextual access to all the information you need to increase your productivity in minutes.

We are a team of passionate product people and engineers that gets excited about solving complex processes and creating value for people.

We're a venture funded company backed by Accel Partners, Vertical Venture Partners, and other leading venture capital firms and angel investors such as Ash Patel and Jerry Yang.