In part three of our series, we look at common hold-up points that cause delays. We also cover what real estate agents can do to push through them and close on time.

Hold-Up Points of Delayed Contracts

Getting buyers and sellers to the closing table on time has been tough this year. Only 67% of contracts are settling on time, according to the July Confidence Index survey from the National Association of Realtors. In a normal year, around 75% of deals close on time.

A quarter of recent delayed contracts fell into NAR’s “other” category, likely due to COVID-19 related issues. But the majority of recent transaction delays are familiar for agents, such as:

- Financing issues

- Appraisal issues

- Title issues

- Inspection issues

- Insurance issues

- Contract contingencies

Here’s a look at these common hold-up points and what you can do to help your buyers and sellers reach the closing table on time.

Financing Issues

Issues related to obtaining financing have been the number one real estate transaction delay for buyers and sellers this summer.

Many delays continue to be routine, but some deals hit a snag due to a buyer’s job loss or other financial hardship..

In a perfect world, you would work with a well-qualified buyer. One who submits their loan documentation on time, with no surprises with the appraisal, inspection, title search, or insurance quote. The lender then follows through perfectly with underwriting and the necessary disclosures.

But usually, there’s at least one piece of this complex process that needs special attention to push through on time.

There’s not much an agent can do about a client’s job loss, but you can help clients through other financing issues. Make sure they’re preapproved, follow up on those paperwork deadlines, and be there to offer advice if there’s an issue.

Real Estate Appraisal Issues

A lot depends on the appraisal, including the buyer’s financing.

Your real estate transaction could come to a standstill if there’s a problem and neither side wants to budge on the price. But a lender can only approve financing for the appraised valuation, so something has to give.

Ideally, the seller lowers their asking price, the buyer ups their down payment, or the two parties agree to meet somewhere in the middle.

With so much riding on the appraisal, the longer it takes to agree to a price adjustment, the more likely it is the transaction won’t close on time.

Resolving a low appraisal quickly is key. In limited cases, a seller may be able to challenge the appraisal for inaccuracies. But more frequently, a compromise will be required.

Explain your clients options to them and the risks of a delay. Practice good communication with the other party’s agent to work past difficulties quickly.

Transaction Title Issues

Real estate title issues can seriously impact your closing timeline. The sale can’t go through until the title is clear of any legal claims by a third party, such as liens, judgements, or bankruptcies.

Almost all titles have small defects. Often these can be remediated with a simple signature on the right form in a matter of days.

But it’s bigger issues that cause most title delays, and these defects are not uncommon. About one-third of title searches find a title issue that may take weeks to resolve.

The title company may need its signature from a contractor or beneficiary that can’t be found. Or, the search could turn up liens from delinquent taxes, past-due spousal support, or spousal fraud issues.

A buyer’s agent can help by ensuring the title search is ordered promptly. This makes sure there is time to address any problems that do come up.

A seller’s agent can avoid delays by ensuring the client has taken care of outstanding debts, taxes, contractor bills, and divorce paperwork before the house is under contract.

Inspection Issues

Inspections usually turn up something that needs to be fixed. But many closing delays are due to a disagreement on how to deal with repairs or issues.

It’s easier for motivated parties to get past the inspection and negotiate a fix. A motivated seller can credit the buyer at closing for the cost to make repairs after they move in, while a motivated buyer can decide to shoulder some or all of the cost of fixes to keep the seller happy.

Things get more complicated when certain repairs — such as a roof, foundation, or termite remediation — are required by a lender to finance the sale. There is no hard and fast rule about who must pay for repairs, so your closing can hit a snag if negotiations break down.

Agents can play a key role in keeping things moving after an inspection. Beyond repairs and concessions, sellers could offer to purchase a one-year home warranty for the buyer, throw in appliances or furniture they had been planning to keep, or drop the price and list the home as-is if the first buyer backs out.

Insurance Issues

With insurance generally required for all financed sales, a high quote or refusal of coverage from an insurer can spell trouble for a closing.

Most transactions are not impacted by a problem with insurance. The premium is affordable, the property is insurable and the sale can proceed. Yet for about 1% of delayed closings, insurance issues are to blame.

Issues can vary. A buyer could get sticker shock if updated FEMA flood maps mean they need hazard coverage on top of a homeowner’s policy. Fixer-upper homes with neglect or damage can fall below FHA insurable standards. Even nice homes can be flagged as uninsurable due to missing railings, overhanging trees, unfenced pools or other hazards.

Agents can help by being proactive. Advise buyer clients about insurance requirements in high risk areas.

Sellers agents should inform their clients about potential problems like flood maps, dead trees, and obvious structural issues, and tell all clients to ask for a quote as soon as they’re under contract.

Contract Contingencies

Problems with contract contingencies can easily push back the settlement date since there’s usually little time to fix them.

When all goes well, you and the buyer will do the final walkthrough, checking for a home that’s empty, undamaged, and clean. The negotiated repairs have been completed and the appliances included in the sale are present and accounted for.

Depending on the circumstances, unfulfilled contingencies can put the whole transaction in jeopardy. If the pool had to have a fence for the insurance and loan to be approved, it’s a problem if this repair hasn’t been done.

Facilitating communication is key to making sure that contingencies are being fulfilled on schedule. If a seller can’t make repairs before closing, an agent can suggest concessions to fund the buyer completing the work after close, which will help things stay on schedule.

As a real estate agent, you play an important role in keeping everyone on the same page. That can be difficult when you’re juggling multiple transactions and your inbox is a mess.

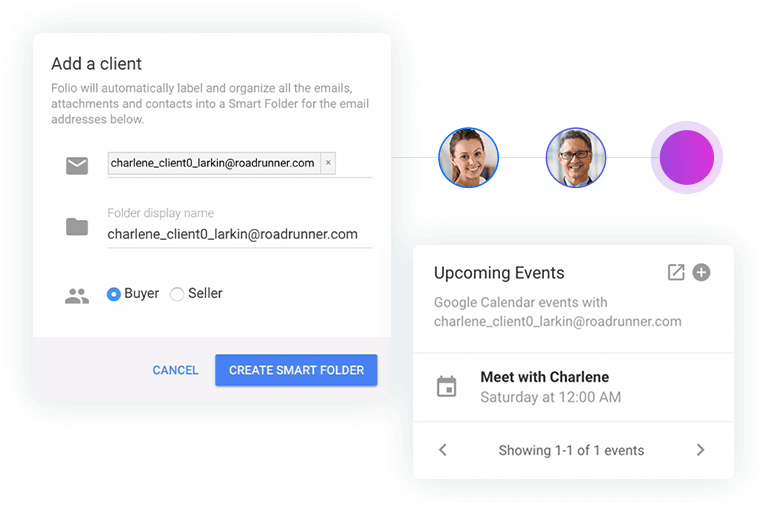

An email organization tool like Folio can really help. Not to brag, but Folio’s AI-powered algorithms help you save time and stay on schedule by filtering and organizing your inbox automatically.

It’s our trick for how to close on time, even when you’re faced with these common hold-up points.

Who we are

We've built Folio: the first AI email assistant for professionals.

Folio plugs directly into your work email inbox and automatically organizes your email, giving you contextual access to all the information you need to increase your productivity in minutes.

We are a team of passionate product people and engineers that gets excited about solving complex processes and creating value for people.

We're a venture funded company backed by Accel Partners, Vertical Venture Partners, and other leading venture capital firms and angel investors such as Ash Patel and Jerry Yang.