Overview

- Colorado home buying process is similar to other states where a closing agent (who is usually an escrow agent or representative from a title company) is used to consummate the transaction and prepare all the closing documents.

- In Colorado, buyers and sellers often consummate the transaction at the same closing (or ‘settlement’) table.

- Colorado’s standard home buying contract has its own peculiarities and deadlines that are spelled out in a comprehensive “Dates and Deadlines” section that buyers are advised to pay close attention to.

Step by Step

Part 1: Disclosures, inspections, and title

These are the initial tasks once a buyer is in contract, and are most often done in parallel to Part 2: The mortgage process:

- An offer is accepted by the seller and a contract is signed.

- Concurrently, a deposit, or earnest money, is paid to an escrow agent, an attorney, or broker (never to the seller directly).

- The signed contract is sent to a title company to begin the title search and all work related to transferring and changing the title to the new owners and preparing the title commitment and title insurance. Tip: the earlier a title search is done, the quicker buyers can be appraised as to any defect (liens or assessments on the title) that can affect the value of the property.

- The buyer reviews and signs off on any disclosures. These disclosures vary based on property type but often include things like known flaws with the property, prior improvements or repairs, and potential environmental hazards.

A form called a seller’s property disclosure is often provided by the seller on or before the day the contract is signed. Sellers may see making these disclosures as beneficial to themselves, and believe that buyers will build these pre-disclosed facts into the contract price (and thus sellers may be reluctant to provide any credits for these defects). - If the house was built before 1978, a specific EPA-mandated lead paint disclosure will also be required, stating whether or not the seller has knowledge of any lead paint present on the property. The property may also be required to disclose any methamphetamine labs that might have been present on the property at one time.

- Any water rights that come with the property will be disclosed by the seller.

- If the property contains a water well, a ‘change of ownership’ form must be completed prior to or at closing. If the well has never been registered with the state, a buyer may wind up having to pay for this and register the well within a certain number of days after closing.

- The buyer can perform inspections on the property (and report on their findings if any defects are found) by a specific date, indicated in the Inspection and Due Diligence section of the contract. This date is called the inspection objection deadline. The types of inspections vary by property type and situation (and locale), but in Colorado, a licensed home inspector generally inspects the home first, and other inspections and tests can be ordered if revealed to be necessary by the initial inspection.

Failure to complete inspections and/or bring up any inspection objection with the seller before the expiration of the inspection objection deadline is the same as waiving this contingency. A property survey may also be ordered during this stage (many lenders will require it), and a radon inspection may also be performed in certain areas. - If the buyer finds something unsatisfactory during inspections they can report it as an inspection objection on a standard form, walk away, and recoup their earnest money deposit. Or, the buyer and seller can negotiate for repairs or closing cost credits for a period of time that expires on the have until the inspection resolution deadline. Otherwise, the deal terminates and the buyer can recoup their earnest money deposit.

- Additionally, the buyer may wind up with a set of due diligence documents (colorado-specific) if there are any standing leases or obligations of the seller with regards to the property. The buyer then has until the due diligence documents objection deadline (colorado-specific) to break off the deal if anything unsatisfactory is found in these documents.

- The buyer may also negotiate for a home warranty (a.k.a. ‘home protection plan’) that covers major appliances from failure for a time period after the sale, typically a year.

Part 2: The mortgage process

For those borrowing to purchase their home, the mortgage process is usually the most stressful and opaque part of the transaction. It’s best to start as early as possible and be ready to produce lots of documentation. The following is the general process in Colorado:

- A buyer submits a loan application to their lender, either directly or through a mortgage broker. Of course, well before this point, a pre-qualification or pre-approval with a lender should have been acquired.

- Within 3 days, the lender sends a “good faith estimate (gfe),” or GFE, to the buyer that is a breakdown of estimated closing costs. The final costs are likely to deviate from this estimate. See a sample GFE at hud.gov.

- The buyer sends a series of personal financial disclosures to their lender. These vary by situation, but the most commonly requested documents are:

- Several months of statements for each bank account a borrower holds (including any investment accounts)

- Several months of statements for any outstanding loans, lines of credit, or other liabilities. This can also include documentation of rent payments.

- Up to two years of tax returns, released to the lender via an authorization submitted by the buyer using IRS form 4506-T.

- Recent pay stubs and contact information for each borrower’s employer. The number of pay stubs varies by situation.

- Any other disclosures that are material to a borrower’s financial situation. This includes but is not limited to marriage licenses, divorce settlements, child support, liens, bankruptcies, or judgments. If there’s something that affects how much money you have on hand that isn’t shown by simply looking at your salary, be prepared to document it.

- Explanation of any credit inquiries

- Substantiation of any large deposits or cash gifts that aren’t regular income. In some cases, a large cash gift may look similar to a personal loan by a friend or family member, and lenders will require gift letters from those that gave you the cash gift, stating that the gift was not a loan. They may also ask for itemized deposit slips.

The exact amount that triggers this requirement varies by the situation (for instance, a $1,000 cash gift may be material to a single borrower that makes $35,000/yr but may not be material to a borrower that makes $350,000/yr), so it’s good practice to ask your lender if you suspect you might have a material cash gift or large deposit – so you aren’t surprised by this at the last minute. - Repeated and updated documentation of any of the above. Keep in mind: to a lender, anything can happen to a borrower’s personal financial situation and credit during the escrow process. Thus, you may be asked more than once for the same type of document so that your lender has the most recent pay stubs, rent receipts, bank statements, or other disclosures that may change over time. Any material changes in these documents -or any element of your personal financial situation- may require the lender to reassess your eligibility for the loan for which you’ve applied.

- The lender renders an approval decision, and if approved, issues a loan commitment letter, stating its willingness to fund the mortgage provided certain conditions are met. These conditions usually include appraisal (so the lender can confirm that the property you’re buying isn’t worth far less than you’re paying) but will also generally include any material change in your situation -or the property- as initially disclosed to your lender.

- The financing contingency, or loan contingency, is removed by the buyer before the expiration of the loan objection deadline, which is defined in the contract as a date by which any objections buyers have to the loan they’re able to get from a lender (or any rejection) must be communicated in writing to the seller if a buyer would like to get out of the deal and recoup their earnest money deposit (provided they were diligent in applying and following up to pursue their mortgage).

- An appraisal is ordered by the lender or mortgage broker via a central directory of appraisers (often called an Appraisal Management Company or AMC) and is set to take place before the expiration of the appraisal deadline. Choosing a specific appraiser is not possible, but a mortgage broker can reject an appraiser and ask for a new one.

Colorado contracts will include an appraisal objection deadline before which buyers must act on any appraisal coming in under purchase price by informing the seller, in writing, if they wish to walk away and recoup their earnest money deposit. - Homeowners’ insurance is purchased (or substantiated, if the property being purchased includes homeowners’ insurance as part of association fees or similar arrangements), and proof of homeowners’ insurance is submitted to the lender. Most Colorado contracts will include a contingency for this so that if a buyer is unable to obtain insurance on the home, they can walk away. They must work this out, however, by the property insurance inspection deadline.

- Hazard insurance may also be required by the lender to protect the asset from fire and storms. If the property is located on a flood plain, then flood insurance may be necessary as well.

Tip: As this process can be long, arduous, seemingly arbitrary, and is often critical to your homebuying transaction, try to prepare these documents (or at least figure out how to prepare them) in advance. Also, do not make any changes to your employment or credit until your transaction is complete (not just until you get a loan commitment letter). This means not switching employers even if it results in a higher income, as counterintuitive as that may sound. It also means not leasing or financing a car, opening a new credit card account, or anything else that can affect your credit report.

Part 3: The closing itself

The closing, itself generally takes place at one table (either at the office of a lender or title company), where buyers sign all documents related to their loan and the transaction itself. After all documents are signed and payments exchanged, buyers generally take possession of the keys after the deed is recorded unless a separate agreement has been reached to allow the seller to stay in the property for a period after closing. The detailed steps that makeup closing are:

- As part of the preparation for closing, the title company performs a title search (if they haven’t already) to determine if there are any liens or assessments on the title.

Provided the title is deemed ‘clear,’ the closing proceeds as planned and the attorney or title company issues a title commitment. All paperwork for changing the title / deed and title insurance is prepared, and a final closing date is confirmed with all parties. - A final cash figure for what a buyer needs to bring to the closing in the form of a cashier’s check is calculated. This is based not only on a mortgage’s closing costs but factors like property taxes and utilities paid in to date by the seller.

- A final walkthrough will usually be performed up to the day before closing to verify the property is in the same condition it was when the process began, provided it’s agreed upon in the contract.

- At the closing or settlement, table, the buyer (and seller) sign all closing documents, including the HUD-1 (see a sample HUD-1 here), and the final loan documents.

- The buyer pays the remaining funds in their downpayment to the attorney or a representative of the title company who is acting as the settlement agent via certified funds.

- The representative from the title company or attorney will then record the transaction and deed with the appropriate municipality.

- The buyer receives the keys and, unless indicated differently in the contract, officially takes possession of the property.

Who we are

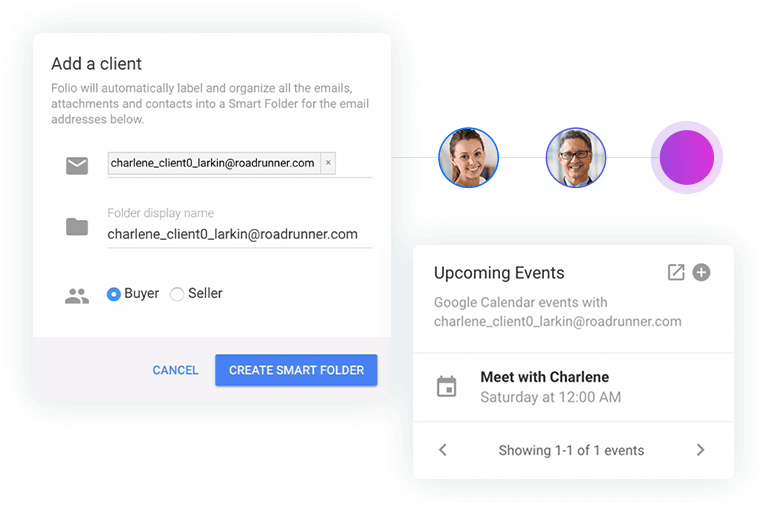

We've built Folio: the first AI email assistant for professionals.

Folio plugs directly into your work email inbox and automatically organizes your email, giving you contextual access to all the information you need to increase your productivity in minutes.

We are a team of passionate product people and engineers that gets excited about solving complex processes and creating value for people.

We're a venture funded company backed by Accel Partners, Vertical Venture Partners, and other leading venture capital firms and angel investors such as Ash Patel and Jerry Yang.